“If returns do not exceed the costs of borrowing, BREIT performance will be depressed…. The effect of leverage is that any losses will be magnified."

From fix-and-flips to private funds to REITs, leverage remains a foundational tool across real estate strategies, even in this high-rate environment. All-cash deals are exceedingly rare. Everyone’s using it, but not everyone is using it well.

A recent study by Jacob Sagi and Zipei Zhu analyzing private real estate funds found that high leverage led to lower net returns, all else equal.2 Looking specifically at those levered from 50% to 70%, “funds employing significant leverage underperform for LPs.” Performance declined in near-linear fashion as leverage increased (see graph below).

That was surprising to us and forced some reflection. When we as practitioners think about leverage, we imagine its effects at the deal level: It magnifies investment outcomes and can significantly drive up return on invested equity. But leverage can also impact firm behavior. At the sponsor level, leverage enables GPs to stretch equity across more deals, unlocking more potential promotes. Although the LP and GP in any given deal both want a high return on invested equity, there’s LP/GP misalignment if the GP is incentivized to boost leverage just to make more investments.

This potential misalignment has not been studied in depth, but there’s reason to suspect it isn’t working in LPs’ favor.

Consider the standard (although not well-defined) categories of private funds: core, core-plus, value-add and opportunistic. It’s been established that in practice, the riskier the target assets, the higher the leverage used, which when you say it out loud feels like adding risk to risk, no? The researchers thought so, and they wondered if fund terms compensate as risk increases, expecting to see higher LP preferred returns or increased GP co-investment in riskier investments.

To examine specifically how LPs and GPs addressed higher leverage, they controlled for a fund’s self-reported risk category, and found that as leverage increased terms did not change in the LPs favor at all. The only material difference? Higher management fees. So LPs in higher-leverage funds aren’t being compensated for the added risk. But they are paying more for it.

A related fact that surprised us: Leverage levels within each fund-type are remarkably consistent across market cycles. Even in funds with challenging vintage years (2010, 2011, 2020) leverage levels “are only marginally lower than… in other years.” You would think in those periods of economic distress - periods with there’s more risk in the underlying assets - lower leverage would be preferred, but that wasn’t the case. This suggests fund managers and LPs may not be thinking about leverage as fully as they should.

Finally, it’s important to note that relative to other characteristics, leverage matters a lot to fund returns. One prior study compared core funds to non-core funds and found they had similar returns but for the impact of higher leverage, while other studies find that when adjusted for leverage and fees, “core assets strongly outperform non-core assets across multiple dimensions and subperiods.” This strongly suggests leverage is not being used to benefit LPs or enhance the returns of higher-performing managers. We’ll discuss fund performance by risk category more in a future issue.

The take-away: Leverage remains a powerful driver of returns, but the risks and misalignments leverage creates are under-appreciated by LPs. Reading this research (citation below) could be a good way for LPs to frame questions of prospective managers. Investors should examine how prospective managers use leverage not just in underwriting, but when assessing ideosyncratic risk in a specific deal and in portfolio construction. And it would be a good first step to reversing the trend seen in the data, which, succinctly, is the “robust underperformance of high-leverage funds” on a risk-adjusted basis.

The Rake

Three good articles.

The tariff impact to construction costs is likely lower than you think, raising construction costs by just 1–3%. Any effect on rents will be minimal and likely delayed. Recession risk remains a far greater concern for the sector.

Washington State has passed legislation capping annual residential rent increases at the lesser of 7% plus inflation or 10%, with a stricter 5% cap for manufactured housing land leases.

Multi-Tenant Retail Surges, Single-Tenant Slips - CRE Daily

Multi-tenant retail investment surged 9.8%, as capital favored necessity-based centers for resilient cash flows and tenant diversity. In contrast, single-tenant retail continued to lag, with cap rates rising for the ninth consecutive quarter.

The Harvesters

Someone making real estate interesting. They don't pay us for this, unfortunately.

Who: 4stay

What: A premier student housing operator with a unique approach: They start by partnering with institutions, securing a mandate and then aggregating private housing nearby to satisfy the university’s housing requirement. All 4Stay’s inventory is managed to institutional standards.

The Sparkle: Universities have many critical but non-educational responsibilities, starting with housing their students. It’s a challenging time overall: Lower federal funding, ever-increasing tuition and more public skepticism about the value of college all push schools to become more efficient with their resources, and outsourcing responsibility for housing students to an aligned and expert partner feels like a smart way to start.

From the Back Forty

A little of what’s out there.

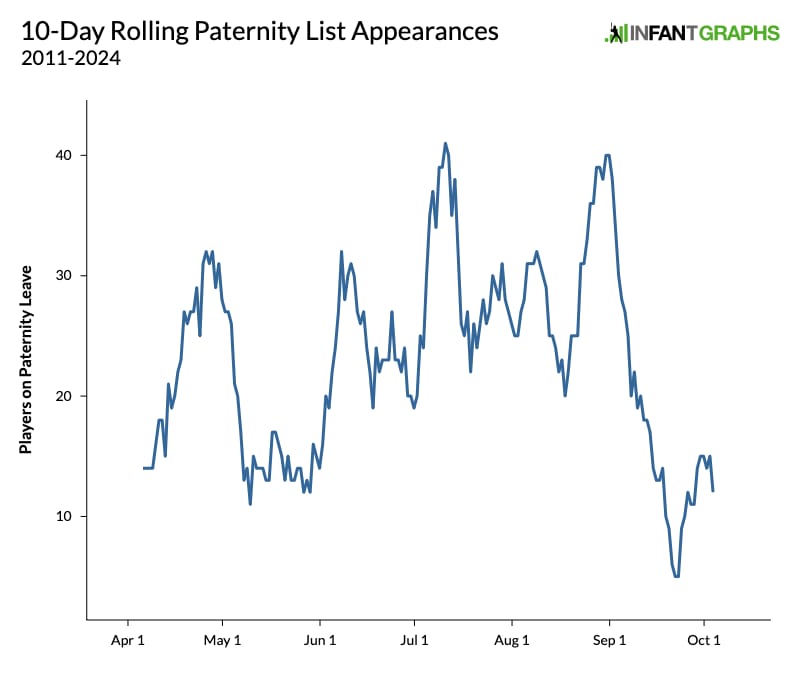

Baseball players are likely the most analyzed athletes on Earth, and if you don’t believe that, consider that we know when they conceive children. It’s been researched: Baseball players have kids in April. Why? It’s about nine months after the All-Star break. No kidding. For a related read and some graphs of baseball baby-having, see the link.

Editor’s Note: The Real Estate Haystack believes in sharing valuable information. If you enjoyed this week's newsletter, subscribe for regular delivery and forward it to a friend or colleague who might find it useful. It's a quick and easy way to spread the word.

2 Sagi, J., & Zhu, Z. (2023, August 23). Leverage in Private Equity Real Estate. Oxford Research Encyclopedia of Economics and Finance. https://doi.org/10.1093/acrefore/9780190625979.013.835