“The Surprise is a somewhat aged man-o-war. Correct?

She has a bluff bow, lovely lines. She's a fine seabird: weatherly, stiff and fast... very fast, if she's well handled. No, she's not old; she's in her prime."

In author Patrick O’Brian’s novels, no one knew better the subtle details of the British naval vessel HMS Surprise than its longtime captain, Jack Aubrey. There’s a parallel in real estate. After years spent leasing, maintaining and improving a building, no one knows more about an asset’s idiosyncrasies than its owner. Aubrey cleverly used this information asymmetry to his advantage in the books and movie, especially when he was in trouble, but in real estate the value of information asymmetry is more nuanced.

Unlike most financial assets, real estate return expectations - especially future distributions - are tied to local market dynamics. This lends an advantage to in-market buyers that “can be more confident when bidding high” on an asset. New research confirms this. In rising markets, locals tend to dominate, and pay lower cap rates. But in times of declining value, the opposite happens. Sellers more often transact with well-capitalized outside investors who lack local-market informational advantages.1

Click to enlarge

The data in these graphs show the preponderance of out-of-market buyers in local markets measured against house price appreciation (x-axis). As appreciation goes up, the share of out-of-market buyers falls, and that holds true in different economic climates. The researchers found the same pattern holds in commercial real estate. Local knowledge dominates the buyer pool in the upswing; dry powder moves in when values decline.

These predispositions lead to the idea that, in down markets, the best buyers for an asset - those high-knowledge local investors that could likely create the most value in local acquisitions - often are not the ones that end up buying it. This makes sense in context.

In periods of a local market shock, smaller investors with heavily local portfolios struggle on multiple fronts. Property performance declines and financing on those assets becomes stressed, the compounding effects of which mean liquidity gets tight quickly and assets need to be sold. This is when outside investors can bring their dry powder and a long view to assets for which they see attractive valuations while in-market investors are sidelined. The paper distinguishes between these two phenomena: During a market shock, a direct impact is more distressed assets for sale and an indirect impact is fewer active local buyers.

The result? Out-of-market investors enter a less competitive, declining market. Consistent with that theory, the authors find the share of out-of-market investors “increases significantly” in these periods, especially in markets where prices fall the hardest.

Maybe you’re thinking that in down markets out-of-market buyers play into a “greater fool” scenario, and in some ways you’re right: Exits to out-of-market buyers on average lead to higher returns for sellers, which raises the question: are these outsiders consistently overpaying?

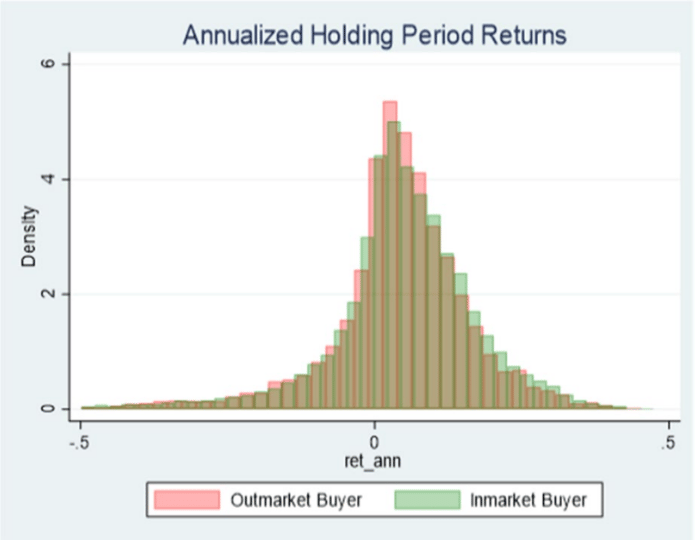

Maybe, but maybe not. The authors speculate that these out-of-market, lower-knowledge buyers see and need to be compensated for the risk inherent in the information asymmetry. They want to avoid the “winner’s curse.” And there’s support for that: Out-of-market buyers on average pay less, about 20 basis points higher in cap rate, than local buyers, in both up and down cycles as illustrated in the right-skewed red bars in the graph below. And, out-of-market buyers are significantly less likely to acquire complicated assets “where they have a significant information disadvantage, such as troubled properties.”

Click to enlarge

In other words, the tendency for an out-of-market investor to “over-pay” for an asset is significantly tempered by the degree of information asymmetry. The data also shows out-of-market buyers have a clear preference for newer, higher-quality investments where “uncertainty around values may be less.” Out-of-market investors with capital quickly become skittish as they face a greater informational disadvantage, the researchers find, noting that dry powder, “is most useful when you can hit what you are aiming at.”

The researchers reviewed purchase transactions from 2001 to 2018, capturing the GFC and the ensuing recovery. During the Great Recession, although prices declined broadly, “there was still significant variation both regionally and by property type,” and that heterogeneity is the perfect grist for the mill of this analysis.

So how does this show up in the returns? Unsurprisingly, across all transactions, if a buyer creates a high return for the seller, that buyer “is likely to have a lower return when they sell.” And as noted, since out-of-market buyers more often provide those strong exits, locals tend to outperform. That suggests local buyers should on average perform better. And the returns data supports the theory that such an edge exists: In-market buyers, on average, see higher returns than out-of-market buyers. The difference is small but persistent, reflected in the small rightward skew of the green bars below.

Click to enlarge

Another finding: investors in troubled or “fire sale” properties see higher returns at sale, usually 1% to 3% higher vs. the average. But that premium isn't evenly distributed. In-market buyers of troubled assets earn a higher return premium than out-of-market investors do, which makes sense as troubled properties require more informational advantages to appropriately assess.

Stepping back, we found some useful lessons in all this, especially for owners navigating down markets. The research makes clear the trade-off between access to capital and access to information, and how that trade-off reshapes the buyer pool when prices fall. When prices fall, well-capitalized out-of-market buyers tend to step in—not because they see more upside, but because they’re still able to transact. They actually aren’t “fools” and they’re not insensitive to risk. Quite the opposite: the evidence suggests they’re aware of what they don’t know, and they price accordingly.

That has a practical implication for sellers. When pricing starts coming down, the marginal buyer is often from outside the market—and that buyer is underwriting uncertainty as much as cash flow. Newer, cleaner assets are attractive to these buyers. So is a deep, well-organized diligence process that reduces perceived informational gaps. In stressed markets, price is shaped less by who can imagine the most value creation and more by who can get comfortable fastest. Sellers should let that logic guide their process.

Special thanks to the Burns School of Real Estate at the University of Denver for their support of the Haystack.

The Rake

Three good articles.

Senior Housing Occupancy Reaches Multi-Year Peak - CRE Daily

Senior Housing Occupancy Hits 18-Quarter High as Supply Stalls Senior housing occupancy has surged to 89.1%, fueled by a delivery drought.

Multifamily Faces a Long Road to Recovery - Globe St.

Multifamily's Recovery: A Marathon, Not a Sprint The multifamily sector faces a protracted deleveraging cycle as it digests the remnants of the 2024-2025 supply wave, with rent growth likely to remain stagnant.

The Fed's Not Budging, Inflation Is High, But Retail Boosted By Trillion-Dollar Holiday Sales - BisNow

Retail Resilience Complicates the Fed’s Pivot A record-breaking $1 trillion holiday season has validated retail fundamentals, but this consumer durability is proving to be a double-edged sword giving the Fed cover to keep rates elevated.

The Harvesters

Someone making real estate interesting. They don't pay us for this, unfortunately.

Who: AI White Paper

What: An approach to AI that will make where you work better.

The Sparkle: This white paper illustrates an important though rarely noted point: The book on AI is not yet written. Shopify’s strategy to provide access to robust AI tools and push AI adoption throughout the firm yielded surprising results, especially from departments that weren’t considered prime AI users. Some of this article is not applicable to real estate firms, but a lot of it is. For just one highlight skip to “Foster a beginner’s mindset (and hire more beginners).”

From the Back Forty

A little of what’s out there.

The federal workforce shrank nearly 10% since President Trump took office. However you feel about that, notes real estate economist Dr. Peter Linneman, it’s shocking. That’s especially true in light of prior administrations’ unmet aspirations to make government more efficient and/or trim it outright. We spoke to Peter about this in the latest issue of Stacked, a new publication where Peter and the Haystack team explore recent events critical to real estate investors, and in which we all benefit from Peter’s considerable insight.

Thank You To Our Sponsors

Editor’s Note: The Real Estate Haystack believes in sharing valuable information. If you enjoyed this week's newsletter, subscribe for regular delivery and forward it to a friend or colleague who might find it useful. It's a quick and easy way to spread the word.

1 Kim, JE., Krainer, J. & Nichols, J. Dry Powder vs. inside Information: The Role of out-of-Market CRE Investors. J Real Estate Finan Econ (2024). https://doi.org/10.1007/s11146-024-09999-8