“Retailing is very tough."

Cannabis dispensaries have become a fixture of the retail landscape. Twenty four states have legalized the non-medical use of cannabis. For medical users, that figure climbs to forty. In nearly all cases cannabis is sold through dispensaries, which in many cities are now so common as to be their own category of retail tenant. The exciting novelty of the first dispensaries is gone; the laws of retailing gravity have taken hold and now dispensaries earn their customers’ loyalty with high quality products, affordable prices and engaging customer service. The local pot dealer, RIP.

From the landlord’s perspective, dispensaries often pay high rents, but there’s a downside: Other tenants don’t want to be near them. Recent research - the first to look at local CRE implications of cannabis legalization - found that within a one-mile radius retail rents drop 15% to 29% after a dispensary opens, compared to similar areas without one.1

Unsurprisingly, the largest rent decreases were seen locally, within one-half-mile of the new dispensary, and the decreases abated as distance from the dispensary increased. Rent drops also were particularly acute for retail assets in highly walkable neighborhoods. Similarly, larger dispensaries pulled down nearby rents more than smaller ones.

The spread of dispensaries - now more than 15,000 nationwide - is no surprise given widespread legalization, and we’d expect more dispensaries as more states legalize and make licenses easier to obtain. Also not surprising: the neighborhood backlash. The research cites a 2024 Pew study which found 57% of U.S. adults support legal recreational cannabis and 88% support legal medical use, but nearly half of adults are opposed to dispensaries in their neighborhoods. Those NIMBY concerns center on increased crime, more people loitering nearby and a potential uptick in homelessness and drug use.

Interestingly, many of those fears aren’t well supported by facts. The authors cited findings from other researchers indicating neighborhood non-violent crime and alcohol and drug-related crimes drop when a dispensary opens, although “nuisance-related” crime and car break-ins increase “in close proximity to dispensary openings.” More broadly, studies have found cannabis legalization has led to reduced alcohol and opioid consumption evidenced by lower alcohol sales and lower rates of binge-drinking, and a drop in opioid perceptions and opioid-related emergency room visits.

Regardless of actual outcomes, after a cannabis shop opens in the neighborhood, worries about crime and other “uncertainty surrounding possible negative externalities” clearly kept retailers from opening nearby.

An interesting twist: There was an indication that the impact on nearby retail rents is temporary and retailers’ interest in the affected neighborhood returns. The study found rents consistently started to rebound five quarters after a dispensary opened. But it was impossible to say that was a definitive trend; the study’s authors caution it’s too early to call. More data is needed.

We were happy to see the author’s research methods were straightforward. They identified dispensary openings across the U.S. and using CoStar investigated rents from new retail leases in neighboring properties both before and after the dispensary opened. They also found comparable retail assets that had not seen dispensary openings nearby. Other explanations like broader supply and demand trends were ruled out as not responsible for the observed drops in rent.

The research also hints at what may happen the next time newly legalized drugs create an entrepreneurial ecosystem with real estate needs. Oregon and Colorado have laid the groundwork for psilocybin “healing centers” where patients could be treated with psilocybin-related psychedelics under supervision.

While Colorado has only one business selling mushrooms, and you might call that a dispensary, and it’s far from clear the best way for that industry to interact with customers, that interaction will be in a physical, licensed space. From living in Colorado and knowing people exploring this business, it feels like psilocybin facilities might look less like specialty retailers and more like doctor’s offices or even spas. Sounds smart, and perhaps they won’t be as aversive to their prospective neighbors.

Special thanks to the Burns School of Real Estate at the University of Denver for their support of the Haystack.

The Rake

Three good articles.

U.S. Apartment Market Softens in August - RealPage

RealPage's latest data shows a softening U.S. apartment market, with occupancy easing and annual rent cuts returning for the first time since the pandemic.

The collapse in lumber futures from record highs signals a potential shift in the housing market, suggesting that an oversupply of wood and a drop in demand may be undermining residential construction.

Growth in the QSR space is being led by chicken, coffee, and Mexican chains, but a closer look at the data reveals declining visits per location. Is aggressive unit expansion in these booming categories creating an oversupply problem?

The Harvesters

Someone making real estate interesting. They don't pay us for this, unfortunately.

Who: Field AI

What: Software company that’s “pioneering robotic autonomy.” for construction monitoring.

The Sparkle: The next time you’re visiting a construction site don’t be alarmed if you see a dog wandering around. Actually if it’s a real dog you should say something, but it’s probably a FieldAI product. Their powered robots autonomously capture construction progress and materials on site. It builds 3D models and can even compare what’s being built to the plans and specs. The real innovation is their “robotic brain” software, for which the company just pulled in more than $400M (thanks Jeff Bezos!) to keep improving its field IQ.

From the Back Forty

A little of what’s out there.

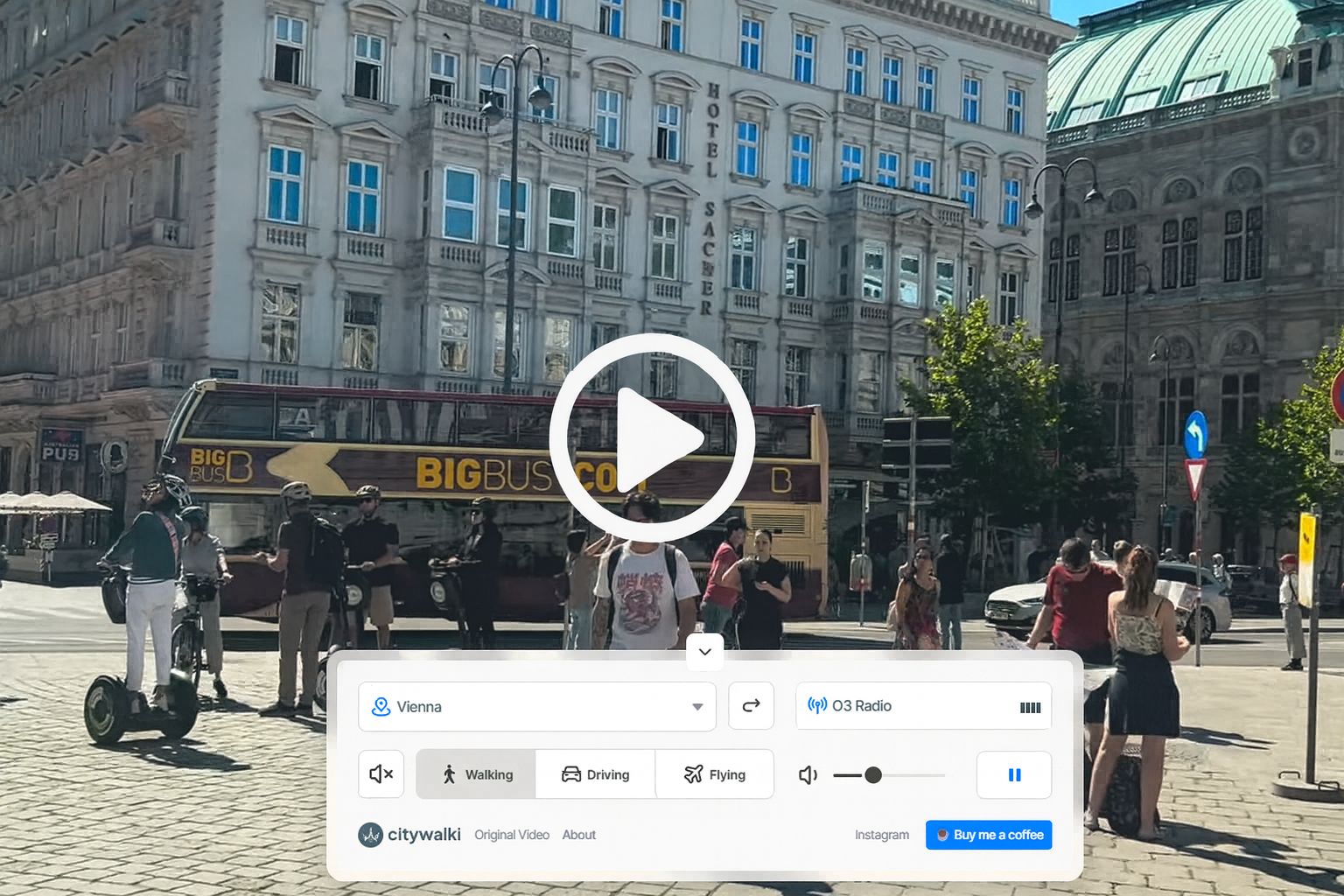

In a world of digital miracles, it’s about time someone tried to bring analog back. Sort of. CityWalki is a free site that lets you walk, drive or fly around more than 200 cities. No ads, just high-def exploration and an option to play local music. It’s immersive and calming, except if you’re driving in Mumbai. Thanks to Matt Knight at PropTech Angel Group for this gem.

Thank You To Our Sponsors

Editor’s Note: The Real Estate Haystack believes in sharing valuable information. If you enjoyed this week's newsletter, subscribe for regular delivery and forward it to a friend or colleague who might find it useful. It's a quick and easy way to spread the word.

1 Liuming Yang & Jonathan A. Wiley (21 Mar 2025): Do Dispensary Openings Impact Rents for Neighboring Retail?, Journal of Real Estate Research, DOI: 10.1080/08965803.2025.2464458