“Diversification is the only free lunch in real estate."

Markowitz's wisdom has been well accepted and institutional real estate portfolios are built around a familiar logic: diversification, especially by geography and product type. Research confirms the long-term benefits. Pricing differences across metro areas and asset types are uncorrelated enough that diversification drives lower portfolio-level price volatility and improves average returns.

Most portfolio frameworks quietly assume assets can be traded at observed prices, and the benefits of diversification only exist if that assumption holds. But liquidity conditions change significantly and quickly, begging the question: Can a portfolio be diversified to optimize liquidity? A recent research paper asks a similar question that most portfolio models avoid: When markets seize up, does illiquidity stay local—or does it spread?

For large U.S. metros, liquidity commonality is almost twice as strong as return commonality. The pattern holds across apartments, office, retail, and international gateway cities. Tradability itself emerges as a shared risk factor, one that especially spikes in downturns. When liquidity seizes up in one market, it is likely seizing up everywhere.1

The authors studied liquidity in private real estate, a market that lacks transparency, so they gathered and looked at differences between bid and ask prices for private transactions (all asset classes) relative to a standard price index. Smaller gaps indicated greater liquidity. This was actually the first paper to examine private commercial real estate markets and test how often market liquidity trends in one area would then be found in others. They studied the 25 largest U.S. MSAs and 18 global markets. International markets show lower similar trends: Liquidity remains more synchronized than prices.

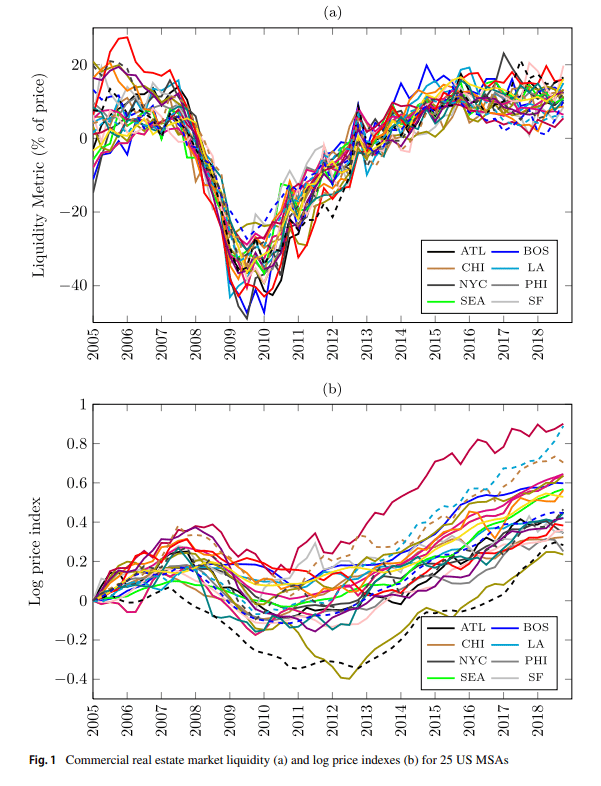

The Global Financial Crisis of 2008–2009 provides a clean illustration. Liquidity fell during the GFC, and “the recovery in market liquidity to pre-crisis levels (2010–2014) is remarkably similar across different markets.” Price indexes show co-movement as well, but “the co-movement is much smaller than that of the liquidity indexes.” You can see these relationships in the graphs below, the top one reflecting liquidity in major US markets, the bottom one reflecting pricing.

So how do you fix this? How do you optimize a portfolio for liquidity? The authors suggest there is very little an investor can do within private real estate to diversify it away. (We at the Haystack want a second opinion.) They identify two conditions that drive liquidity changes:

Risk premia co-move more than NOI. Cap rates and financing trends are national, moving together across markets with correlations often above 0.80. Rents and NOI growth, by contrast, respond to local drivers.

When risk premia move, sellers adjust slowly. They anchor to past pricing expectations while buyers reprice faster. The resulting disagreement widens bid/ask spreads across markets simultaneously when capital markets shift.

Those factors taken together mean liquidity is dominated by capital-market changes that synchronize across markets. Correspondingly, the paper implies that you can’t optimize for liquidity with geographic diversification, sector diversification (office vs. apartments vs. retail) or international diversification. These strategies drive returns. They do not insulate for liquidity.

These findings help explain why fund vintage matters so much, perhaps arguing for “vintage diversification.”

The uncomfortable conclusion is that liquidity is not a portfolio attribute. It’s a market condition. Investors cannot diversify the capital market that prices risk. The only real solution as an owner is to be in a position to hold assets through periods of low liquidity. That reframes what “prudence” actually means in private real estate. It’s not just owning the right mix of markets, but owning the option for more time. Diversification still works, just not when you need it most.

Special thanks to the Burns School of Real Estate at the University of Denver for their support of the Haystack.

The Rake

Three good articles.

America’s reindustrialization ambitions are hitting a physical wall: a critical shortage of power-ready industrial sites is stalling advanced manufacturing projects.

The "construction cliff" is finally arriving: with industrial starts down 62% and multifamily deliveries tapering off, 2026 forecasts predict a sharp pivot toward vacancy compression across both sectors.

IOS rents have soared 123% since 2020, driven by limited supply, rising demand, and fragmented ownership structures ripe for consolidation.

(Additional IOS insight here)

The Harvesters

Someone making real estate interesting. They don't pay us for this, unfortunately.

Who: Splitero

What: An innovative and popular new way for homeowners to tap into their home equity.

The Sparkle: Splitero does not provide home equity loans in the traditional sense. Homeowners effectively pledge an interest in their house in exchange for cash but with no monthly payments to make. Later, the homeowner pays back that amount plus Splitero’s profit - which is considerable - when the house sells or is refinanced. Splitero does not require income checks or debt-to-income requirements. While not right for everyone, this mechanism creates liquidity to help homeowners resolve consumer debt or afford critical large purchases when otherwise they could not. This idea has fans: Splitero recently closed a $283 million rated securitization of its assets, the largest rated securitization of its kind.

From the Back Forty

A little of what’s out there.

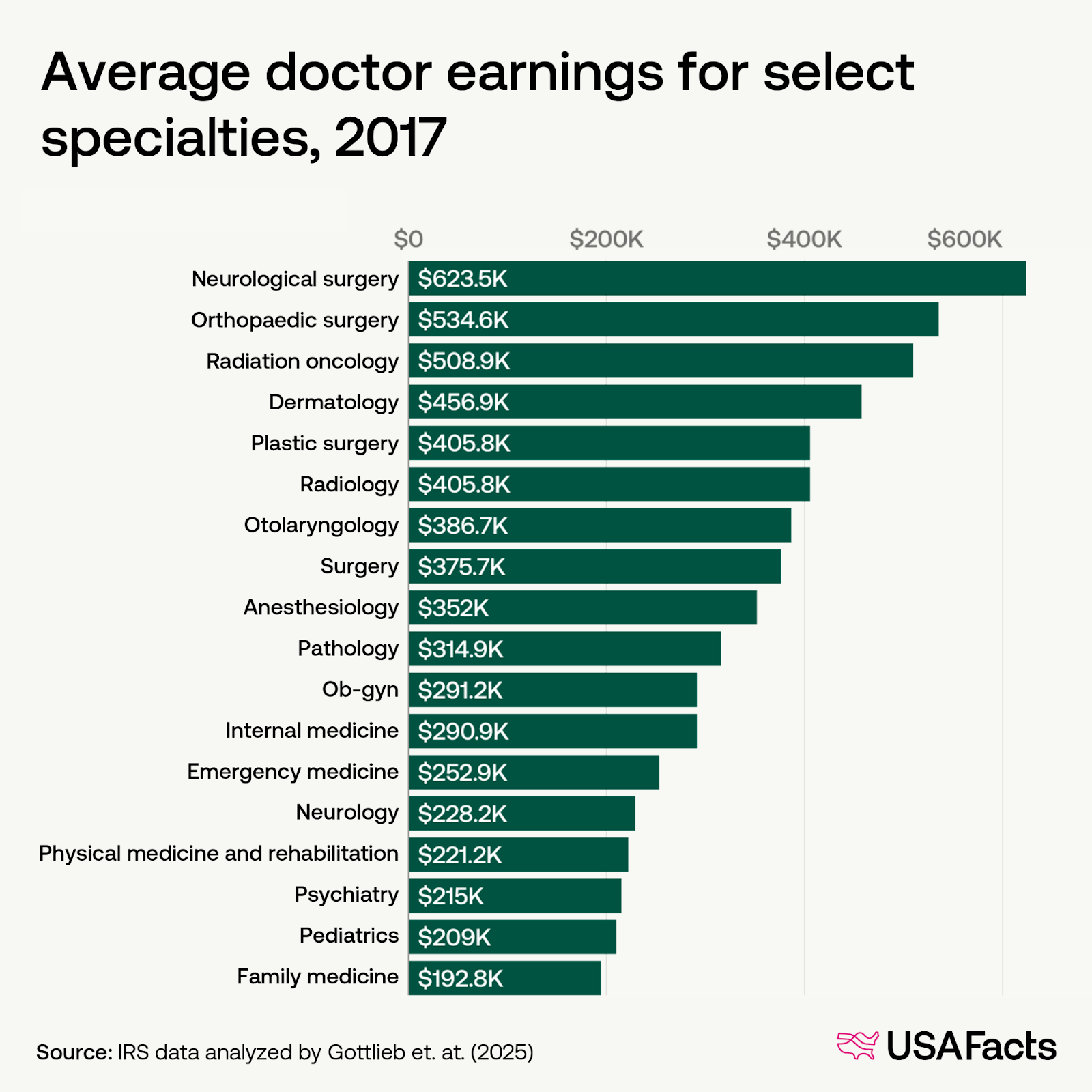

Ever wonder how much your doctor friends make?

The answer: Whoa does it depend, but it’s more than most people think. Speciality matters a lot - less than $200,000 for family medicine doctors on average, more than $600,000 for neurosurgeons - averaging to $350,000. Where they live matters a lot too, owing to different Medicare reimbursements and quality of life in that location. The more desirable a place to live, the lower the doctor’s salary.

Fun fact: The highest-paid doctors live in South Dakota.

Thank You To Our Sponsors

Editor’s Note: The Real Estate Haystack believes in sharing valuable information. If you enjoyed this week's newsletter, subscribe for regular delivery and forward it to a friend or colleague who might find it useful. It's a quick and easy way to spread the word.

1 van Dijk, D.W., Francke, M.K. Commonalities in Private Commercial Real Estate Market Liquidity and Price Index Returns. J Real Estate Finan Econ 71, 141–177 (2025). https://doi.org/10.1007/s11146-021-09839-z