“Whereas most technologies tend to automate workers on the periphery doing menial tasks, blockchains automate away the center. Instead of putting the taxi driver out of a job, blockchain puts Uber out of a job and lets the taxi drivers work with the customer directly."

Advocates like Buterin will say decentralization of the financial system is better for everyone and real estate DeFi use cases get cited often as ways could improve the status quo. Boiled down, blockchain and the ability to tokenize real estate ownership interests have the potential to create two significant advances: lowering the friction of deal execution, and creating entirely new ways to invest. However, neither is playing out at scale - there are no institutional blockchain real estate markets. And with a few years of history to review, there are reasons to think some of these advances will not fully mature for a long time, if ever. A new research paper helps explain why.1

First, tokenized ownership creates the potential for reduced transactions costs. Countries like Georgia and Sweden have adopted blockchain-based land registries, making transfers and financings easier through digital, immutable records. Collectively those efficiencies could be meaningful, but since real estate trades infrequently and even at scale, tokenization would not reduce overall transaction costs or complexity meaningfully, this does not feel like the use case to lead with in the pitchbook.

Second, Blockchain has the potential to make real estate more liquid. This is a big deal, as liquidity is a critical driver of value for any property type, especially for large commercial assets. The newfound liquidity comes from fractionalizing ownership of a single asset or portfolio into non-fungible tokens, which themselves can be bought and sold. The opportunity for ownership liquidity - even partial - would appeal to real estate investors who could diversify and reallocate their holdings quickly.

The first use case is about infrastructure and a modernized transfer processes. The second one is a new financial securitization that would expand the real estate capital markets universe. In the infrastructure use case, Adam sells Dan a property with a little less friction and gets paid in normal American dollars. In the second one, Adam sells Dan a small interest in that property and gets paid in… well, there’s the rub.

Research shows that real estate tokens bought with cryptocurrency are highly susceptible to volatility related to the crypto currency itself. Meaning, Dan might own a token worth 0.1% of a very stable real estate portfolio, but the value of that token can fluctuate dramatically as crypto values change and especially when there’s a crypto hack or heist, of which there have been many. After a crypto attack, investors get spooked and many real estate tokens “become inefficient and experience a significant decline in liquidity,” exactly the opposite of what this market was designed for. These events can shake investors' “confidence in the entire cryptocurrency ecosystem.”

Some sponsors raise money through “large capitalization” investment tokens, selling many fractional interests to raise significant funds for broad real estate investing or lending strategies. TokenFi token and Hifi Finance token are good examples. These investment funds have the tokens most sensitive to crypto events, which are “rapidly increasing” in frequency and scale, one paper notes.

But the market for real estate tokens is not homogenous. Some real estate tokens do not represent ownership interest at all, and instead are “utility tokens” used to pay for services on real estate sales platforms, like Propy and Propchain. Services include listing properties for sale or viewing property ownership histories, among other things. Unsurprisingly, utility tokens do not absorb hacker-driven volatility. They do trade on exchanges but in low volumes and only as a way to help process real estate transactions.

Tokenization faces other headwinds as well, especially legal uncertainties. Title transfer, securities status, and token-holder legal rights lack standardized treatment. Without legal clarity institutional investors are likely to stay away. The title issue in particular illustrates how much progress is left to be made. Although token platforms provide digital representations of ownership, the legal ownership still resides off-chain in SPVs or land registries. In practice, in the U.S., this creates dual systems. Blockchain for real estate “remains an add-on layer to existing systems,” a separate paper noted.

In the near-term, tokenization’s promise isn’t in reinventing capital markets, it’s in fixing the plumbing. It turns out that use case might deserve the front page of the pitchbook. Using blockchain to record ownership and process closings is low-risk and already has proof of concept. The “investment” version is a different animal. Tokens tied to returns behave more like crypto than real estate, and the risks may take years to quantify. Even then, tokenized ownership has to outperform a familiar benchmark: a boring liquid low-friction REIT. If it can’t beat publicly traded real estate, why tokenize the exposure at all?

For now, tokenized capital markets seem a long way off. The smarter bet is on better infrastructure—useful, dull, and far more likely to work.

Special thanks to the Burns School of Real Estate at the University of Denver for their support of the Haystack.

The Rake

Three good articles.

National multifamily vacancies held at a record 7.2% in November as a relentless wave of new inventory collided with stalling household formation.

Marriott, Sonder implosion detailed in court filing - Hotel Dive

Marriott severed ties with Sonder following its Chapter 7 liquidation, exposing the inherent fragility of master-lease models. This collapse serves as a warning on counterparty risk within branded residential partnerships.

[Additional Marriott/Sonder News: here]

Warehouse real estate is stabilizing as demand shifts, reshoring rises, and power access becomes a key driver for tenants.

The Harvesters

Someone making real estate interesting. They don't pay us for this, unfortunately.

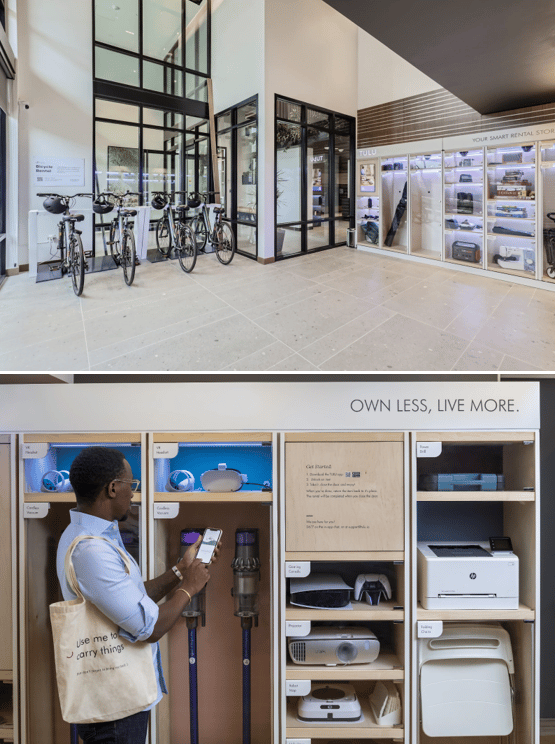

Who: Tulu

What: Provides things renters and office workers and residents need - from groceries to scooter rentals - in the lobby of your building.

The Sparkle: Tulu is basically a storefront built into the lobby of a property. One hundred percent app-operated and customizable by the landlord to include grocery/retail sales, rentals of things like gaming consoles, projectors and vacuums, and even scooter and bike rentals. The Tulu wall looks great and allows “tenants to enjoy what they need when they need it,” as they say. Tulu just closed a $37 million Series A funding round, so if you haven’t seen it yet, you likely will soon.

From the Back Forty

A little of what’s out there.

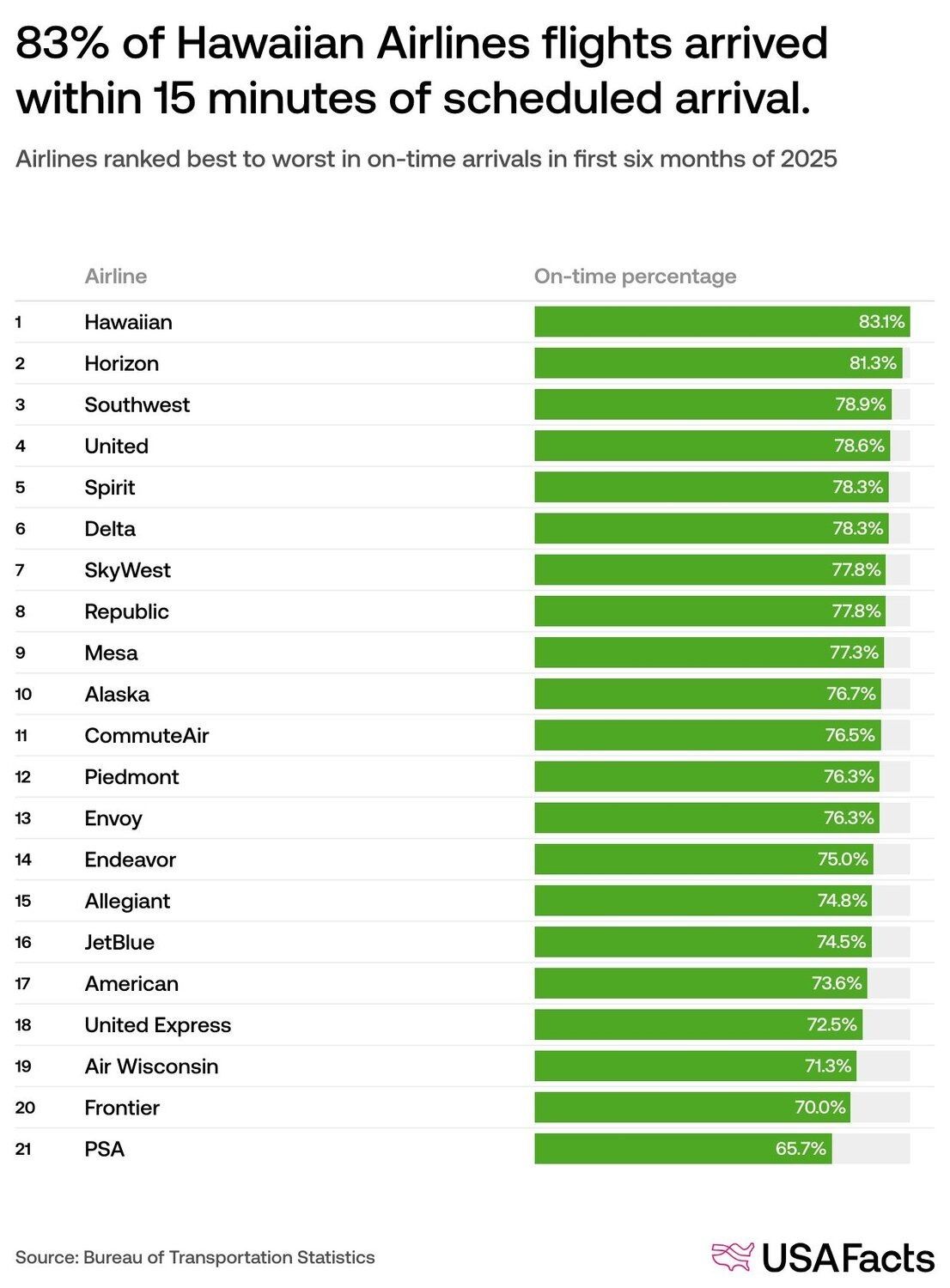

Everyone knows some airports are worse than others for on-time arrivals, but the differences between the best and the worst are striking. Flying into National Airport in D.C.? You’re almost 33% likely to be more than 15 minutes late. Salt Lake City, that drops to nearly 15%. Click the link to see how your city performs and check out the table to find out how your favorite airline stacks up.

Thank You To Our Sponsors

Editor’s Note: The Real Estate Haystack believes in sharing valuable information. If you enjoyed this week's newsletter, subscribe for regular delivery and forward it to a friend or colleague who might find it useful. It's a quick and easy way to spread the word.

1 Viktor Manahov, Mingnan Li, The digitalisation of the real estate market: New evidence from the most prominent crypto hacker attacks, International Review of Financial Analysis, Volume 103, 2025, 104166, ISSN 1057-5219, https://doi.org/10.1016/j.irfa.2025.104166